|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Bankruptcy in PA: Essential Facts and Insights

Understanding Bankruptcy

Bankruptcy in Pennsylvania (PA) is a legal process that helps individuals and businesses struggling with overwhelming debt. Filing for bankruptcy can provide relief and a fresh financial start.

Types of Bankruptcy

- Chapter 7: This type involves liquidating assets to pay off debts.

- Chapter 13: This involves a repayment plan to pay off debts over time.

The Bankruptcy Process

Filing a Petition

To begin, you must file a petition with the court. This document outlines your debts, assets, income, and financial history.

Automatic Stay

Once filed, an automatic stay goes into effect, halting creditor actions such as wage garnishments and collection calls.

Court Proceedings

The court will evaluate your situation and determine the appropriate course of action based on your financial status.

Pros and Cons

- Pros: Debt relief, fresh start, and protection from creditors.

- Cons: Impact on credit score, potential loss of assets, and public record of filing.

For those outside of PA, seeking the right legal advice is crucial. Consider consulting a bankruptcy attorney in Lakeland, FL for specific guidance in your area.

Considerations Before Filing

Evaluate Alternatives

Consider other options such as debt consolidation or negotiation before deciding on bankruptcy.

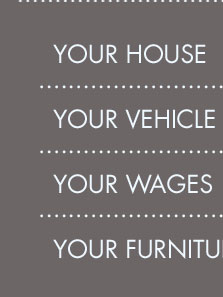

Understand Exemptions

Pennsylvania offers certain exemptions that may allow you to retain specific assets during bankruptcy.

Frequently Asked Questions

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

Chapter 7 involves liquidating assets to pay debts, while Chapter 13 involves a repayment plan over time.

How does filing for bankruptcy affect my credit score?

Bankruptcy can significantly lower your credit score, but it also provides a chance to rebuild it over time.

Can I keep my home if I file for bankruptcy in PA?

It depends on the type of bankruptcy and available exemptions. Consulting a legal expert is advisable.

If you're considering bankruptcy outside of Pennsylvania, a bankruptcy attorney in Long Beach, CA might offer valuable insights tailored to your jurisdiction.

In this article, we will cover the basics of what you need to know regarding filing for bankruptcy in Lebanon, PA.

It now costs $338 to file a Chapter 7 bankruptcy and $313 to file a Chapter 13 bankruptcy, whether for one person or a married couple. The court may allow you ...

trustee is appointed, the trustee takes control of your business and property.

![]()